The Question

Facebook is considering getting into the Travel industry. Should they do it?

How Are You Being Evaluated

This product management interview question is a typical market entry question. The interview question tests whether you have a structured way of analyzing market entry questions using strategy fundamentals.

The interviewer is evaluating you on the following:

- Can you apply basic strategy principles? (e.g., Porter’s Five Forces, the 5 Cs)

- Do you structure your analysis in a clear and logical manner?

- Can you synthesize your analysis and objectively support your final decision?

- Can you backup your decision with estimates?

Answer Structure

There are multiple ways to structure your answer in a market entry question. In this example, we will borrow parts of the methodology from the book Playing to Win: How Strategy Really Works by A.G. Lafley and Roger L. Martin. Here is how we will structure our answer:

- Where to Play: Identify where in the travel-industry value chain Facebook can provide a solution, given its core mission and synergies with a particular service.

- How to Win: After choosing where to play (services in the value chain where Facebook can add value), run a competitive and customer analysis. What is the competition offering? Determine if Facebook possesses a business or technology capability that would differentiate it and provide a competitive advantage.

- Core Capabilities: Determine which core capabilities would Facebook require to compete in the services chosen. Evaluate the feasibility of acquiring missing capabilities. Examples of core capabilities are technology, market knowledge, customer knowledge, partnerships, sales knowledge, relationships with suppliers, and others.

- Size the Opportunity: Estimate the size of the market for the service chosen and its growth rate. Is it worth investing in entering this market?

- Recommendation: Give a final recommendation based on Facebook’s strengths in core capabilities and the size of the opportunity.

Answer Example

INTERVIEWEE: There are multiple companies in the travel industry that provide different services such as travel recommendation sites and reservation sites for airline tickets, tourist packages, accommodation reservations and others. The first thing I would do is decide where in the value chain Facebook could play. Second, determine how Facebook can win, in other words, does Facebook have a competitive advantage to make it a market leader in the chosen space. Third, decide if Facebook has the core capabilities to play in this space or does it need to acquire them. As a result of the last two steps, competitive advantage and core capabilities, I may narrow down the services that Facebook is best fit to target. Finally, I will evaluate whether it is worth entering this market based on the previous analysis, opportunity size, and risk.

How does that sound?

INTERVIEWER: It sounds promising, please go ahead.

INTERVIEWEE: Okay, let’s start with describing the travel industry value chain to get a lay of the land:

I will begin by listing some of the existing mainstream services in the travel industry value chain.

- Recommendation sites, like TripAdvisor, where people go to share and find information about other people’s travel experience to inform their decisions about where to go and what to do.

- Tourist operators, like Viator, offer information and reservation services for tourist packages.

- Online Travel Agencies (OTAs): OTAs like Priceline and Orbit, where people make direct reservations for air tickets, hotels, and car rentals.

- Online hospitality businesses, like Airbnb, for travelers to plan and reserve their accommodations.

- Work travel online reservation systems, like Concur, provide a booking solution system for enterprises to use internally to manage business travel. Enterprise employees make work travel arrangements that go through an approval process that helps companies track travel expenses.

I may have left some services out, but these are the ones that seem more prevalent in the industry. Is there one you think I should include?

INTERVIEWER: No, this is a good list. Please continue.

Where to Play

INTERVIEWEE: Okay, so the first part of my analysis is to determine where Facebook can play in this value chain. To answer this, I would look at two things: a fit with Facebook’s mission as a company and synergies between the travel industry and Facebook’s core products. Finding a fit with the company’s mission is important to align management with the new market objectives. And, technology and market synergies between the travel industry and Facebook will make it easier to attain market leadership faster.

Given Facebook’s mission statement, “to give people the power to build community and bring the world closer together,” I think the first four travel services fit within this mission. A traveler’s site, like Travelocity, helps people in the world build community and come together; tour operators and online travel agencies help people travel to new countries to experience other cultures; and the hospitality businesses, like Airbnb, help people come together by sharing the way they live. However, I do not see how Work travel businesses, like Concur, fit within this mission. Solutions, like Concur, target enterprises to make travel logistics more efficient which does not align with Facebook’s mission.

Regarding technology and market synergies, these four services align with Facebook’s technologies. These sites already try to personalize and create communities to enhance their customers’ experience. This is an area where Facebook has technology advantage and user knowledge. So, I would pick these services as possible places to play. Do you have any questions so far?

INTERVIEWER: No, that sounds reasonable.

How to Win

INTERVIEWEE: Having picked where to play, I will continue with the next step, analyzing how Facebook can win.

To guide my analysis of how Facebook can win, I would like to use a customer journey map as a way to identify what users do and their pain points. A customer journey map will help determine where Facebook can provide a differentiated experience to customers in order to gain market share from the competition.

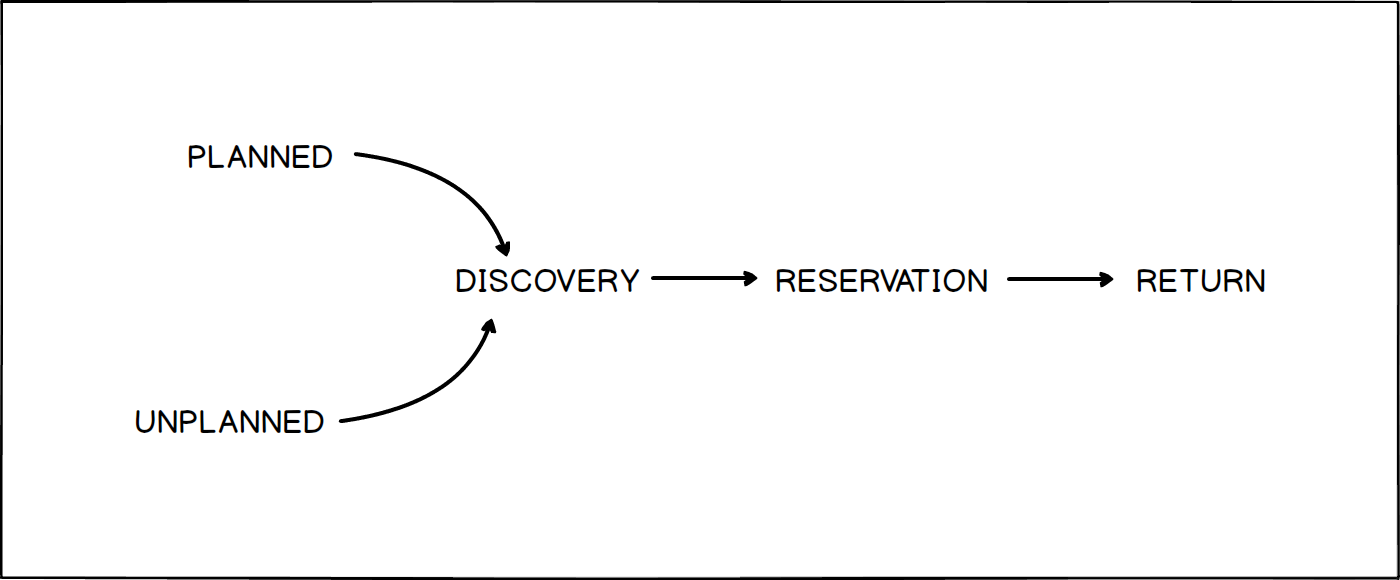

Here is a customer journey map that many people using these services follow:

Pleasure travel drives a large portion of the travel industry; in fact more than 50% of the industry revenue is due to pleasure travel, as far as I know. Since I discarded work travel as a compatible market for Facebook, I am going to focus on pleasure travel. People plan ahead before deciding to travel on the spur of the moment. So the decision to travel is planned or unplanned. In either case, if the decision is planned or unplanned they enter the discovery process and go to travel sites like TripAdvisor to get recommendations for places to visit. After browsing recommendations and deciding where to go, they proceed to make a reservation. Travelers might do the following: use an OTA to reserve flight tickets, visit Viator to reserve local tourist activities, and book accommodations using Airbnb. At the end of their travel experience, some travelers may return to these sites the next time they travel.

I think Facebook can transform this customer journey into a much more personalized experience for the user. Facebook can do this by leveraging its proprietary technologies in social networking, mobile apps, and VR. And, with a daily world audience of to 1.5B+, Facebook has a mass market to jump-start any initiative.

I will go through a few scenarios to illustrate what I mean.

Before Discovery

For travelers that have not decided yet to travel, Facebook is in a pretty good position to raise external triggers to lead them to travel. Its 1.5B+ daily users read their feeds several times a day. Triggers can be raised via friends’ posts about their traveling experience, or posts/videos of celebrities that are traveling, or reminders of the great time they had in Rome last year.

Doing the same with Instagram will likely have a higher impact because of its photo-centered experience. Facebook could be a key lead generator to travel reservations by using its social platform, mobile apps, and massive audience.

Discovery

Facebook can curate photos from its network to show possible destinations once users decide to travel. Facebook can even use its VR technology to create an almost real-world experience of the final destination. Stories from friends about their travel experience could be used to enhance the impact of the photos. While recommendation sites like TripAdvisor also provide recommendations, Facebook has the advantage of having a larger pool of users to tap photos and stories from; in addition to including stories from friends that are likely to be influential.

Reservation

In the reservation process, the user books a variety of services such as airline tickets, car rentals, tour packages, hotels or rooms. This part of the process is transactional in nature so there is less opportunity for personalizing the experience. Still, Facebook could enhance this part by providing up-to-the-minute information about the chosen destination, hotels or activities that the users decided to book. If people book local activities, Facebook could enable users to connect with others that share the same activities, ahead of the trip.

Return

The next time they travel, people may go through the same process of discovery and reservation. Facebook can use its platform to get users to come back for their next travel reservations by reminding them of their past trips using anniversary notes and personalized pages. Users could create personalized pages to show photos and stories of their trips.

These are just a few examples of how Facebook can use its social platform and technologies to exert competitive advantage over other players in this space.

Now, let’s move to determining if Facebook has the core capabilities needed to support these services in this customer journey.

Core Capabilities

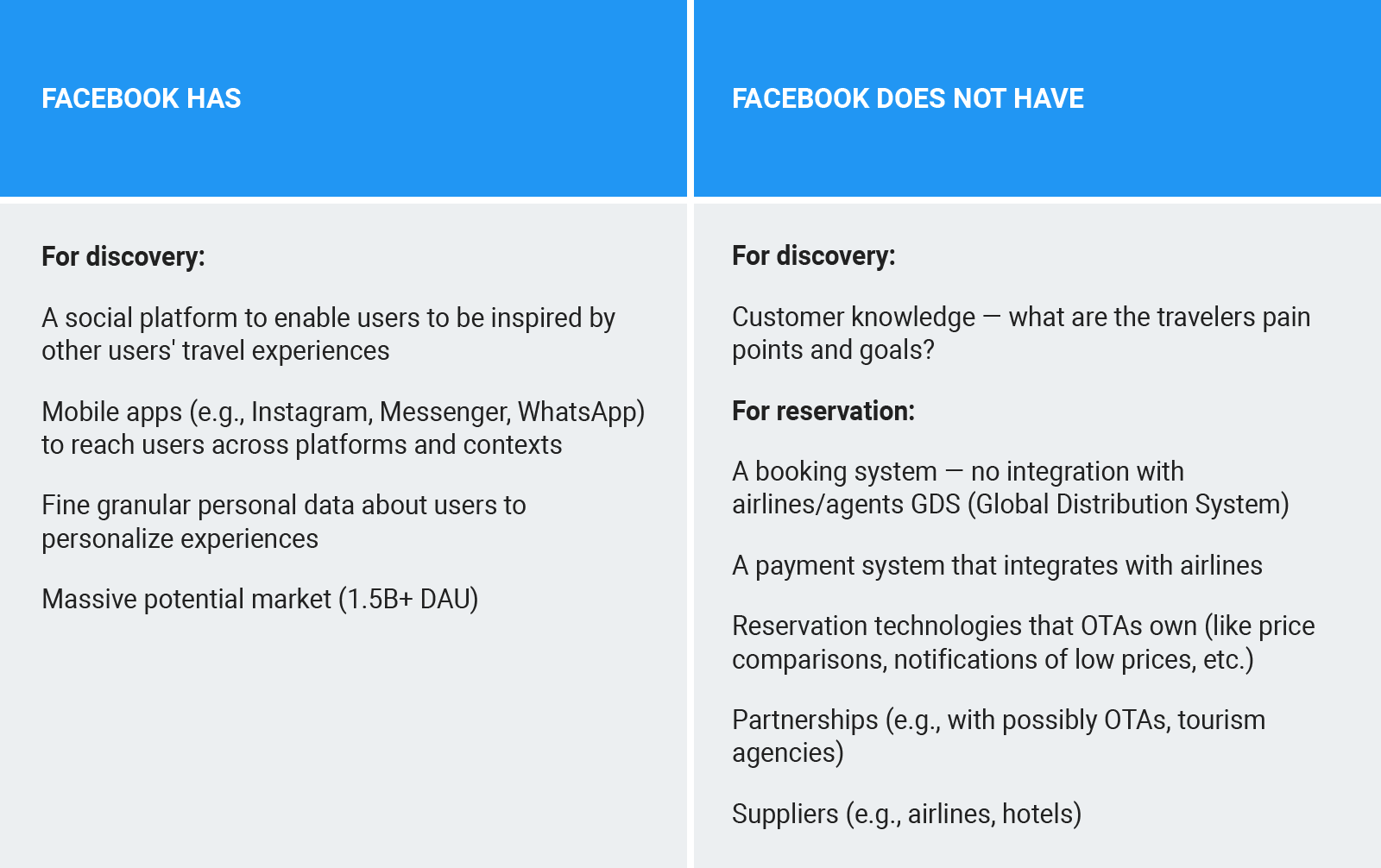

First, I will list the core capabilities Facebook has and does not have, and how this can affect the decision to play in the travel industry.

Okay. Let’s start with what Facebook does have. It has the technology and data to enhance the discovery experience of travelers. Facebook’s social feed and other properties like Instagram, Messenger, and Whatsapp can be used to reach a vast audience to get them into the travel funnel through triggers. This is a unique advantage Facebook has over competitors. Facebook and Instagram have become a daily habit of its 1.5B+ users, an audience that TripAdvisor or OTAs do not have.

Additionally, Facebook’s competitors do not have granular personal data about their users. Facebook does and can use that data to provide a very personalized discovery experience. For example, using travel photos or posts that users liked, shared or commented on, Facebook can infer where users want to travel.

However, Facebook lacks core capabilities in other areas. For example, OTAs have been in the travel business for years. They understand traveler needs and wants when booking a flight or hotel. Facebook does not have this type of travelers knowledge. It is something they would need to acquire by hiring people from the industry.

When it comes to the reservation part of the customer journey, Facebook lacks the technologies to complete the reservation. For example, Facebook does not have a GDS booking system or a payment system that connects to airlines. Facebook also lacks the technologies that OTAs have been optimizing for years to provide a better experience for the traveler when booking. Some examples are price comparisons between different airlines, letting users pick their seats, and letting users subscribe to alerts for special deals on flights or hotel rooms. Finally, Facebook does not have partnerships or relationships with suppliers, such as airlines and others.

So looking holistically at the core capabilities, Facebook would be best positioned to enter the travel industry in the discovery part of the business, where it has most of the core capabilities. Facebook could provide a dedicated space on its platform, via an app or page, where users can research travel planning. And ad clicks for airlines tickets, hotel reservations, activity bookings, or tourist packages would generate revenue.

In the long term, as Facebook learns more about the travel industry, and users see Facebook as a reliable place to do travel planning, Facebook could enter the Reservation space and compete directly with OTAs. That would require a lot more capital investment, as well as technology integration with GDS and payment systems. So it is a riskier move.

INTERVIEWER: So how would you evaluate the opportunity of the discovery market?

INTERVIEWEE: Yes, that is the next step. I would evaluate the opportunity of the discovery market by estimating the revenue Facebook can make from travel ads.

INTERVIEWER: Okay. Go on, please.

INTERVIEWEE: For starters, I would only consider the US+Canada and Europe because those are the world areas where people have the income to travel for leisure, and marketers are likely to target these markets. Although Chinese people are frequent travelers, Facebook, like other American internet companies, have been blocked from China, so I am going to leave China out.

So assuming Facebook has a dedicated page or an app for travelers, ad revenue will come from airline ticket ads, hotel ads, activity ads, or package tour ads. But, to simplify this exercise, I will consider only ticket and hotel ads, which today are the most prominent. Does that seem reasonable to you?

INTERVIEWER: Sure.

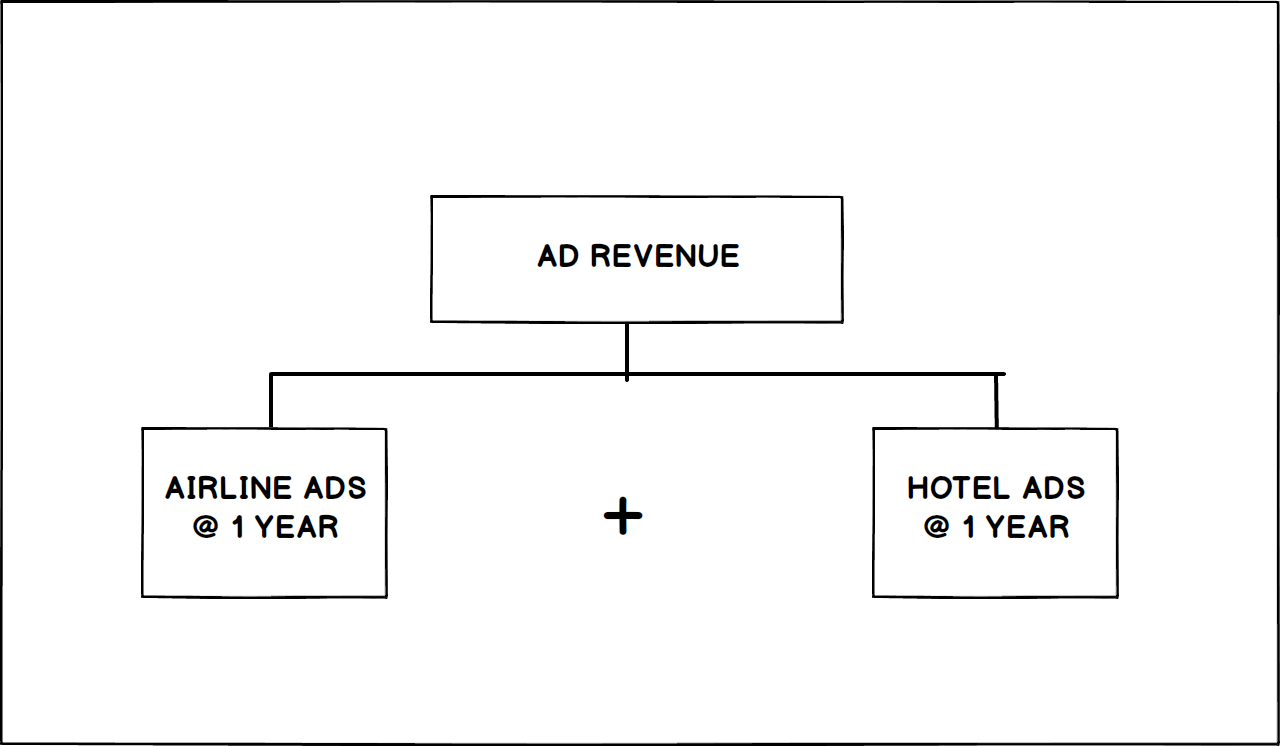

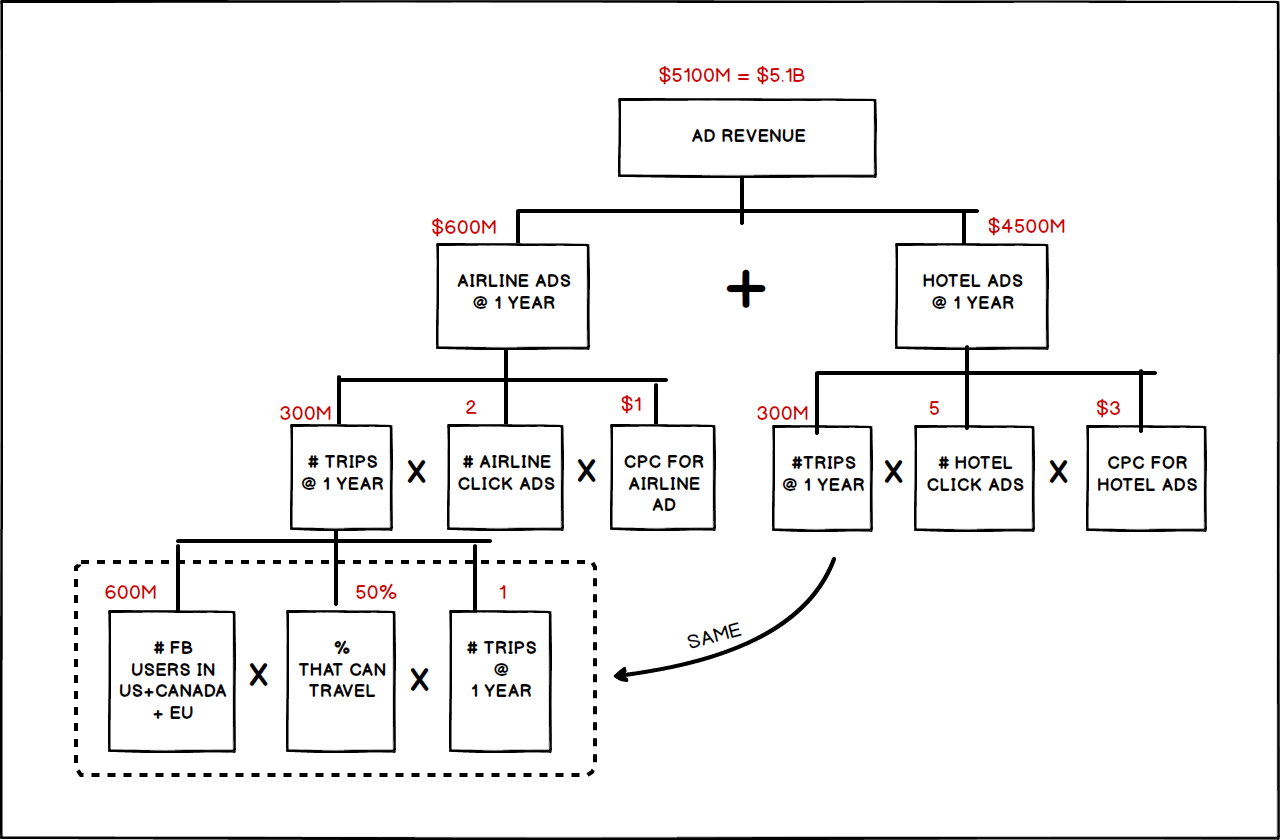

INTERVIEWEE: (The interviewee uses a whiteboard or notepad to draw an estimation tree that will help explain the assumptions and calculations. At the root of the tree is “ad revenue” and the first level of branches are “revenue from airline ads” and “revenue from hotel ads.”)

To estimate ad revenue for a year, I will first estimate ad revenue from airline ads and then from hotel ads. Then I will add these two ad revenue sources to compute total ad revenue.

INTERVIEWER: Okay, that makes sense. Please continue.

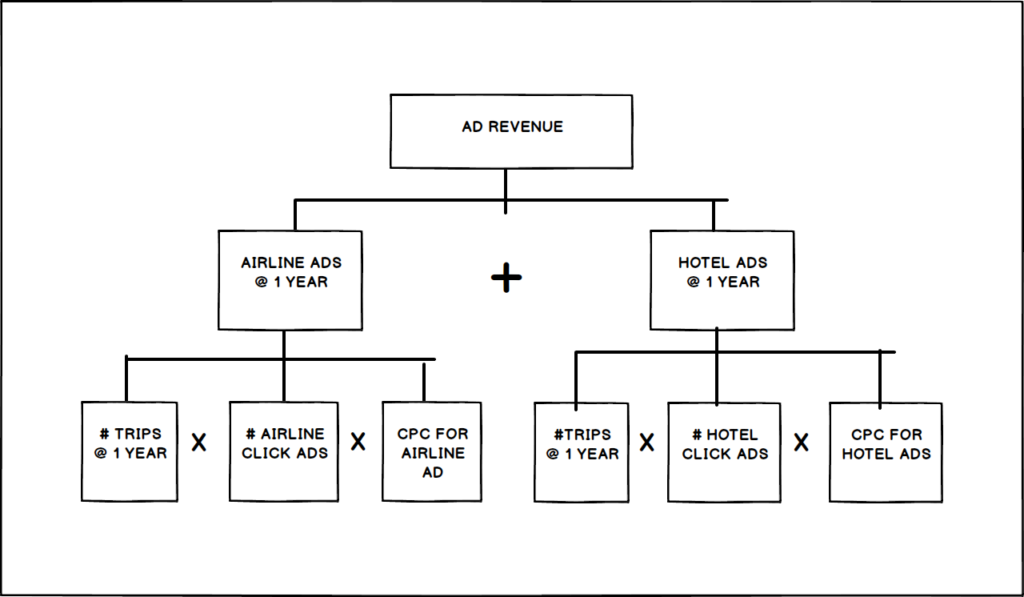

INTERVIEWEE: (The interviewee draws the second level branches and then explains.)

Revenue for airline ads can be estimated by multiplying the average number of trips per year Facebook users in US+Canada and Europe take, times the number of airline ads they would click on, times cost per click (CPC) per airline ad.

Revenue from hotel ads can be estimated by multiplying the average number of trips per year Facebook users in US+Canada and Europe take, times the number of hotel ads they click on, times the CPC per hotel ad.

INTERVIEWER: So are you saying that every Facebook user in US+Canada and Europe that travels will go through the Facebook travel services?

INTERVIEWEE: Yes, this is assuming 100% penetration because I want to size the potential market first. I will bring down this penetration to 10% at the end to get a more realistic estimate. Not everyone will use the Facebook services at launch time, but I think that 10% is a realistic target.

INTERVIEWER: Ok.

INTERVIEWEE: Now let’s see how we can calculate the number of trips per year that Facebook users in US+Canada and Europe take.

(The interviewee draws and starts explaining the calculations starting from the leaves of the tree.)

I can estimate this number by multiplying the number of Facebook users in these two continents, times the percentage of those users that have the income to travel, times the average number of trips per year they take. I know that the number of Facebook users in the US+Canada is about 250M. And, I am going to guess that in Europe it is higher, given the larger population. My estimate would be about 350M, adding to a total of 600M Facebook users on both continents.

(The interviewee writes down 600M on the top left-hand corner of the box that says FB users in US+Canada and Europe. The interviewee continues calculating the numbers for the rest of the boxes. This process helps the interviewer understand how the numbers are calculated and aggregated at each level of the tree. This leaves no doubt as to how the interviewee is arriving at the final estimate.)

My sense tells me that a person in the US or Canada needs to make at least $50K a year to afford a leisure trip. That is about 50% of the working population in the US, and I will assume the same for Canada, where the standard of living is similar. I believe incomes are higher per capita in Europe, but to be on the conservative side, I will assume 50% for this population too. Now, I take about one trip a year for vacation, and I think this is the same for most people with an average income. So multiplying these three numbers we have, 600M users X 0.5 X 1, which is 300M trips per year.

Going up one level in our tree, we can calculate the revenue for airline ads in one year. It is equal to 300M trips/year X the number of airline ads a user clicks X CPC for an airline ad. The number of airline ads I click when making reservations is probably 2, and I know that sites like Kayak charge a CPC of $1 for airline ads. Replacing these numbers then, the revenue for airline ads per year is 300M trips/year X 2 ads X $1 = $600M.

Okay, let’s move to the right side of our tree and calculate the revenue from hotel ads in one year. From our previous calculations, we estimated that the number of trips per year to be 300M. When I research for hotels or accommodations, I usually click on some hotel ads to check them out, maybe five. Now, I know that CPCs for hotel ads are more expensive than for airline ads, about three times, so I am going to assume that CPC for hotel ads is $3. So multiplying these three numbers results in 300M trips/year X 5 ads X $3 = $4500M for hotel ads per year.

Adding the ad revenue for airlines and for hotels results in $600M + $4500M = $5.1B per year.

$5.1B per year is the total potential revenue assuming a 100% penetration. But since Facebook would compete with all the other players in this market, I would start with a 10% penetration assumption, as I suggested earlier. So 0.1 X $5.1B is $500M for the first year.

INTERVIEWER: How can you check that your numbers are not too off?

INTERVIEWEE: Well, I know that the big airlines make on average around $40B a year, and they do not spend more than 1% on advertising. So if we just consider airline advertising and we divide my estimate by the total revenue major airlines make in a year, that should be under 1%. Let’s check. There are about five major airlines in the US that make about $40B, and I would imagine there is half that number in Europe, say 2. Then dividing our estimate of $600M by $40B * 6 = 600M/240B, is about 0.0025 or 0.3%. This is much lower than 1%, but that is expected, considering that our estimate only includes Facebook users and not the entire population in US+Canada and Europe that travels.

INTERVIEWER: Okay, continue.

INTERVIEWEE: Sure. $500M is not a huge market when compared to the $40B+ that Facebook makes in total ad revenue. And, it is not a fast growing market either. The travel industry is an established industry, its yearly growth is in the lower digits, around 5%. However, on the bright side, it would not take much capital for Facebook to develop features to enter this market. Facebook already has the data and technology and only has to invest in development and maintenance which requires just labor.

INTERVIEWER: So what is your recommendation?

Recommendation

INTERVIEWEE: Well, I think the bigger opportunity is in reservation services. Transaction fees for airline tickets, hotel bookings, activity bookings, and other travel reservations can generate higher revenue. Doing a rough estimate, we estimated 300M trips a year, so charging a fee of 10% for an average airline ticket of $500 results in 300M x 0.1 x $500 = $60000M or $60B, take 10%, that’s $6B, just in airline tickets. I have not included hotels and activities reservations.

However, given the capital investment, competition, and lack of market knowledge in the reservation business makes entering this business risky in the short term.

So, my recommendation would be to implement the dedicated page or application feature in the short-term, with two main objectives, to acquire travelers on Facebook and learn about their needs deeply. Once Facebook acquires the travel segment among its users and obtains deep knowledge about their needs, Facebook can more confidently acquire the technologies it needs to perform the transactional part of the reservations phase. In summary, I am recommending a short-term and long-term strategy. The short-term strategy focuses on acquiring customers and learning. And, the long-term strategy focuses on using those learnings to successfully convert customers on the more riskier part of this market, reservations.

INTERVIEWER: Okay, that sounds like a clear strategy. Thank you.